How did the Coronavirus Affect the Forex Market

The dollar has been relatively stable in the face of this pandemic, but will that continue? It’s hard to say. The final math isn’t known as governments and private citizens try to quantify its total effects on our world economy – which is why we’re all so anxious about what happens next!

What was the Federal Reserve reaction after the initial market impact?

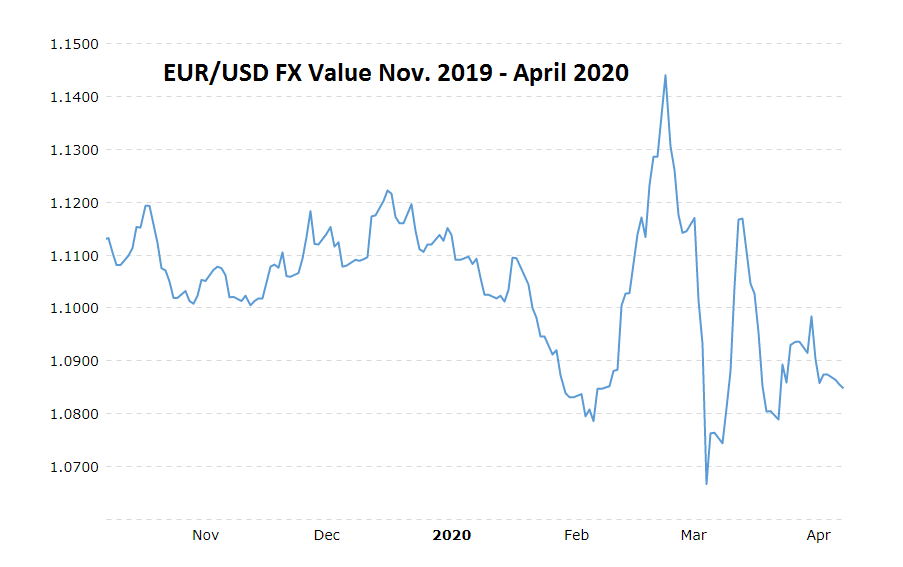

The recent performance of EUR/USD on the Forex market has been relatively stable. In February 2020, as concerns about a global pandemic rose and Italy became an epicenter for this threat to spread throughout Europe it was not surprising that investors looked towards their own currency more closely than usual- with good reason too, because just days after, things took off from there in terms of how big threats could be if left unchecked by our governments’ response ability – or lack thereof.

In mid-March 2020, the US central bank’s move to a near-zero interest rate returned the EUR / USD pair on the Forex market to February values around 1.08 – 1.10.

Тhe Federal Reserve’s rapid interest rate cut as the initial shock of the coronavirus outbreak began to strike across the globe is worth to note, but it did so without having a clear fiscal program ready from the US government. Unfortunately, fiscal stimulus programs implemented in the United States may prove inadequate when lackluster revenues and bad debts emerge. The risks of a new wave of coronavirus infections and the prospect of immune passports remain strong and still have not changed.

The estimated cost for a coronavirus pandemic is difficult to assess, as the societies and economies suffer. Revenue, debt, and risk remain problematic to resolve, and the Forex market has a looming shadow as other important domains within the financial world falter. In April, the energy sector results were extraordinary as crude, through WTI futures contracts, was decimated as demand evaporated, and the outlook for consumption remains difficult to calculate.

The obstacle in the Federal Reserve’s quest for normality

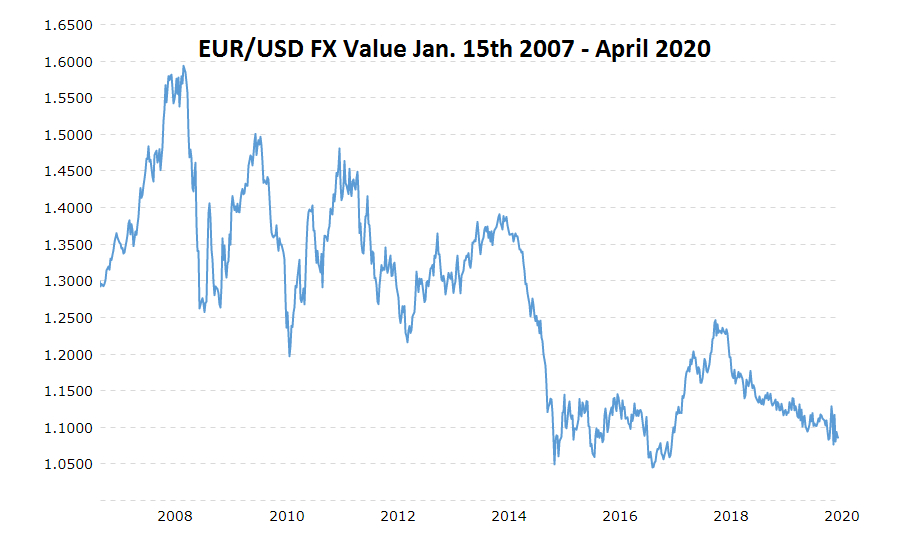

Currency pairs like the EUR / USD had a downward price progression over the past six years since the European Central Bank wasn’t capable of raising the interest rates closer to the US Federal Reserve. The Fed attempted to create a higher interest rate in order to build enough tools to handle an economic crisis for two years. But, starting in the spring of 2019, the Fed’s strong rhetoric about trying to push its main lending rate back up has begun to run into political and economic lockdowns. President Trump lobbied the Fed to keep the US economy fueled with cheap money. The Fed began lowering its interest rate in 2019 and this may have helped the US economy sustain momentum.

The Covid-19 pandemic changed the global economic picture and central banks’ basic plans and assumptions were long gone. A large number of central banks suffered from fragile monetary bases trying to recover and emerge from the big financial crisis of 2007-08. The Federal Reserve’s official mandate became complex. The Fed’s current stimulus policy has made the US central bank susceptible to vulnerabilities it probably wouldn’t be able to anticipate.

We have seen that, since the 2007-08 economic crisis, US Dollar basically maintains a strong uptrend.

We will most probably see the USD maintain its safe-haven status at this time of extreme risk during the coronavirus pandemic. In the short and medium term, we remain confident of a rather strong dollar. But in the long run, however. So, which other currency would you trust the most in the Forex market?

Where does the dollar gets its value from? Is it the trust in the government that is backing it? This answer allows for the analysis of the important behavioral feeling. Which institution do you trust more during the coronavirus outbreak – the European governments and the European Central Bank, or the United States? And if so, why? While the Trump administration and its proclivity for off-the-rails language may appear to be clowns, the United States as a whole had a cohesive core system and a common goal to bring the country back on track. While individual states may disagree on the game plan and give different ideas, the federal system serves to bring together a structure that works toward a common goal.

The European Central Bank suffers from the lack of fiscal unity in the EU

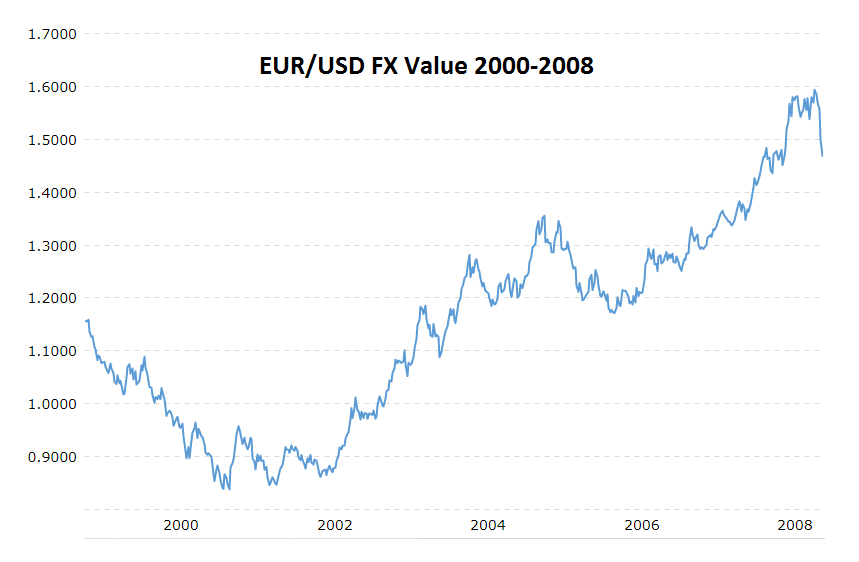

From 2000 until the financial crisis of 2007-08, the assumption that the euro will be worth more than the dollar was popular.

When central banks were asked to rescue the devastation left by collapsed financial firms, however, a common theme emerged: the European Union lacked the cohesiveness necessary to successfully enforce a unified tax platform, as well as politics. A lack of openness on the part of several key US members became obvious, fueling a decade-long fall in the EUR vs the USD.

Is it possible for the EUR to claim to be part of an united EU framework? It’s only an opinion, but the EU is still working towards an individual nationalistic system in many ways. The EU’s core political discord appears to be more focused with safeguarding national economies. From the outside, Germany and other EU members with strong economies are concerned about contagion from weaker countries. Why did Germany reject the concept of a single bond to raise cash to address the ongoing financial crisis caused by the coronavirus pandemic in 2020? They did so because they do not want to be the European Union’s lender of last resort.

Germany does not want to be held liable for bad debts in the future, when countries with weaker economies and a history of poor credit policies will raise their hands and say, “We know we owe this money to the lenders, but we are unable to repay you at the agreed interest rates or within the deadline.” Germany and a few other EU countries might be held liable for bondholder repayment if their fiscal policies are mismanaged. The EU’s weakest and poorest European states simply have a track record of demonstrating that they are unconcerned about budgetary discipline.

Оvercoming trading biases and seeking clarity

A list of interest rate dynamics in the Forex market begins with something like this. What will happen in the second half of 2020, when central banks are forced to respond to really poor economic data? What are the chances of negative interest rates becoming a reality in the United States? There have been allegations that international leaders have little or no “stakes” when it comes to creating policies and releasing dubious monetary stimulants to businesses. As a result, it appears as though we are witnessing a legalized Ponzi scheme in which corporate elites are spared from financial collapse. When businesses react to this, the political implications are clear.

It’s critical to avoid allowing your prejudice to influence your trading and investment decisions. As an American, I acknowledge that I probably have an inherent bias in favor of the US dollar, therefore it’s critical that I keep an eye on the USD’s prospects at all times. My spectacles are currently not pink, but rather gray, because of my concerns about the long-term economic consequences of this epidemic.

I’m not sure how to evaluate the dollar in the long run. While I believe the Dollar will continue strong for the time being, what will happen if there are bumps in the road that are not anticipated? To assure corporate welfare, the Federal Reserve and the US government have embarked on a dangerous road. The troubles of 2007-08, as well as the phrase “too big to fail,” have resurfaced. We’ve seen financial solutions designed to help small companies and enterprises heal their wounds. Is there a chance that any of these will work? The economic difficulties in the United States are still being worked out. Private citizens, large and small businesses, and government organizations are all unaware of the full amount of the financial anguish that might arise, and the global economy is plagued by the same issues. Mortgages, rent, vehicle payments, credit card bills, and cash for food are all key worries in the near future as individuals fight to make ends meet. Corporate debt has been burdened by a lack of income and the inability to pay urgent disbursements, causing agony to banks, supply chains, and, of course, workers who are generally sent home unpaid.

How do institutions in the United States raise the cash they give to individuals in need? They do so by levying taxes and issuing debt to the general public, companies, and foreign governments who feel their money is secure since the United States is a trustworthy debtor. Regrettably, sales are currently declining. What will be the source of funds and how will the bills be paid? The US government is borrowing money to pay for things in the short term while also opening a long-term debt window that may be financially unsustainable, raising major worries about the US dollar’s long-term strength.

The depth of this economic disaster can only be estimated at this point, and the final figures are uncertain. What happens if governments lend money they don’t have, and their revenues are diminished as a result of lower collectible taxes and voluntary buyers of public debt? It’s possible that the entire ship will sink. The prospect that the United States and other world governments are lending money to entities that will never be repaid should terrify citizens. Is it appropriate for the Federal Reserve to purchase subprime mortgage and municipal debt? What happens in four or seven years when bad loan returns build up to a negative financial situation for governments? Are they going to start printing money?

In conclusion

The dollar’s and capitalism’s futures are both in jeopardy. The drop in crude oil prices in April 2020 was a major domino effect that showed the global economy’s vulnerability. The US is about to face a difficult business cycle. We don’t know how terrible the situation is because the data hasn’t been thoroughly captured. However, in the United States, the wide sea of unemployed and long food lines have a catastrophic emotional impact. The dollar is an option for investors and speculators, and it is likely to remain steady in the medium term.However the attraction for the dollar since 2008 is due to the fact that she is the best competitor in a beauty pageant full of unattractive choices. The EUR, JPY and GBP all have economic problems of their own and will have them for the foreseeable future.